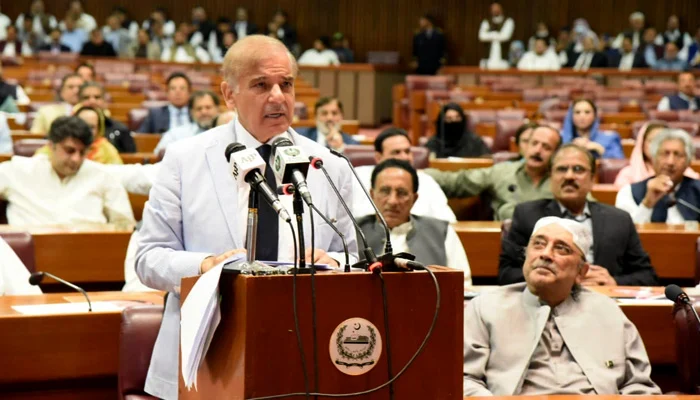

In a year marked by economic recovery and regional uncertainty, Prime Minister Shahbaz Sharif unveiled the Federal Budget 2025–2026 with a clear message: Pakistan is ready to reset its economic priorities. Backed by the International Monetary Fund (IMF) and aimed at curbing the fiscal deficit, the budget introduces bold tax reforms, increased defence spending, and renewed focus on infrastructure and public sector development. As Shahbaz Sharif addressed Parliament, flanked by his finance team, he called the budget a “blueprint for inclusive growth and national security.” But as always, the real challenge lies in implementation.

GDP Growth & IMF Program

Pakistan’s 2025–26 budget — totaling ₨17.57 trillion (~$62 billion) — is anchored by an IMF-backed agenda aiming to reduce the fiscal deficit from 5.9% to 3.9% of GDP and spur GDP growth to 4.2% [source 0news12]. However, analysts warn that achieving these targets hinges on strong tax collection and economic stability

Revenue, Tax Reforms & Deficit Control

Revenue is projected to increase by 14%, driven by new levies like agriculture, retail, and real estate taxes

The Federal Board of Revenue (FBR) aims to collect ₨12.97 trillion, up ~38% year-over-year

Fiscal discipline is maintained by cutting public spending by 7% from last year’s ₨18.9 trillion to ₨17.57 trillion

Defence Spending Surge

Amid border tensions and recent conflict with India, defence allocation increased by 20%, reaching ₨2.55 trillion (~$9 billion)—about 2.5% of GDP. . This rise comes at the expense of non-defense sectors like education, healthcare, and agriculture

Interest Payments & Subsidy Cuts

Interest payments dropped due to rate cuts from 22% to ~11%, creating room for higher military spending

Subsidies have been reduced, but remain valued at ~₨1.36 trillion. The government continues austerity on subsidized services

Development & Infrastructure Investments

- Public Sector Development (PSDP) funds earmarked ₨824 billion, allocated across energy (₨253 billion), transport and communication (₨279 billion), and water projects (₨206 billion)

- Highlights include the Mohmand Dam (₨45 billion) and Diamer-Bhasha dam (₨40 billion)

- Budget cuts on some new energy and EV incentives, though support for solar panel manufacturing continues .

Social Sector & Agriculture

Healthcare allocated ₨27 billion; Education just ₨93 billion — still below 1% of GDP, reflecting underfunding

Agriculture received ₨5 billion — minimal support despite its vital economic role .

Social safety nets like BISP are funded at ₨593 billion .

Challenges Ahead

Analysts warn the 4.2% growth target is optimistic, and deficits might persist as actual revenues could fall short

Historically, tax compliance has been low: only ~1.3% filed returns in 2024

Defence priorities continue to crowd out social and development spending, raising concerns about long-term human capital growth.

Final Takeaway

This year’s budget is carefully crafted to meet IMF mandates, reduce the deficit, and modernize defence capabilities. Yet with austerity cutting across vital sectors, the real impact depends on efficient execution, political stability, and tax reforms. Pakistan is walking a tightrope striving for economic recovery without sacrificing social welfare.