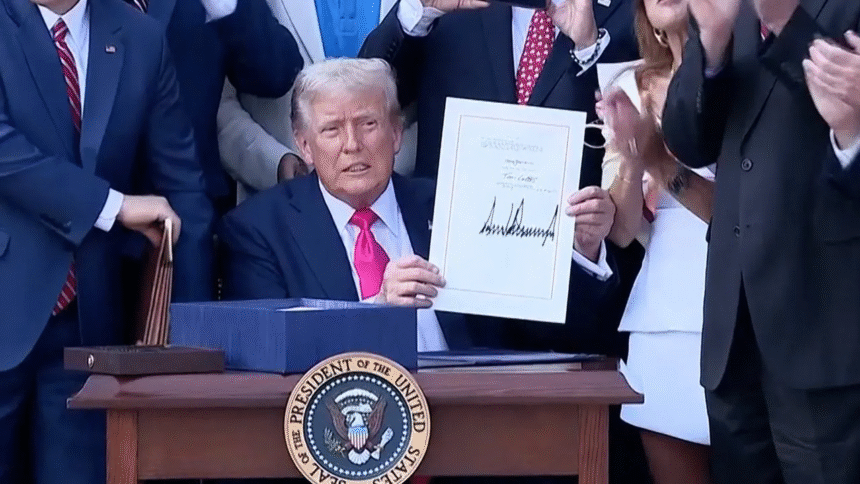

On July 4, 2025, President Donald Trump signed the sweeping One Big Beautiful Bill Act (OBBBA). A budget package combining major tax cuts, social spending reductions, and expanded enforcement priorities. Branded as the legacy-building centerpiece of his second term, the bill has already ignited fierce debate over its long-term economic and social consequences.

What’s Inside the Bill?

Permanent Tax Cuts

The act cements the majority of Trump’s 2017 tax reforms—extending tax breaks for individuals, estates, tips, and seniors. It also raises the Child Tax Credit to $2,200, up from the standard $2,000—though eligibility is limited to households with valid work-authorized Social Security numbers

Medicaid & SNAP Overhauls

To balance its cost, the bill slashes Medicaid by over $1 trillion in the coming decade, introducing stricter eligibility rules like frequent income verification and mandatory work requirements for able-bodied adults It also tightens SNAP rules, increasing work mandates for recipients up to age 64 .

Immigration & Defense Expansion

OBBBA allocates $100 billion for ICE and border enforcement through 2029, including detention and deportation funding . Defense spending rises significantly—an ideological shift for U.S. fiscal policy

Fiscal Impact

By the end of the decade, CBO projections estimate the bill adds $3.3–4.5 trillion to the national deficit, even considering assumed offsets

Reactions: Cheers, Concerns & Controversy

- Trump Administration celebrated the bill as a “benchmark victory,” highlighting tax relief, strengthened borders, and patriotic symbolism (the July 4 signing ceremony complete with flyovers)

- Republican support in the Senate and House passed narrowly along party lines, though a few GOP legislators and moderate Democrat Tom Suozzi opposed parts like Medicaid cuts

- Media responses: Conservative outlets like Fox News praised the bill; however, outlets like AP, Washington Post, Kiplinger, and WSJ highlighted that it would disproportionately benefit the wealthy and unwind vital safety nets .

What’s at Stake

- Social Safety-Net Erosion – Millions risk losing Medicaid or food support in low-income or rural communities, including parents and disabled adults

- Political Fallout – With public opinion skewing 2:1 negative, Republicans may face backlash in vulnerable districts in the 2026 midterms

- Economic Burden – The growing national debt may trigger future interest hikes, reduced fiscal flexibility, or tax increases later—potentially dragging on growth .

What Comes Next?

- Obamacare & Clean Energy Rollbacks: Programs like the Inflation Reduction Act and ACA remain cut, diminishing support for health and climate sectors

- Coverage Threats: States will implement stricter Medicaid compliance—from income recertification to work mandates—that could disenroll millions

- Political Messaging War: Republicans must justify deep net cutbacks as fiscal responsibility—not a burden on everyday Americans—ahead of the midterms

Final Take

The One Big Beautiful Bill marks a bold policy pivot—anchoring Trump’s legacy on tax cuts, strict social policy, and strong executive influence. But as its costs unfold, the U.S. faces real questions over healthcare access, economic equity, and future debt sustainability. The next 24 months will determine if this sweeping overhaul becomes a historic landmark—or a political liability.