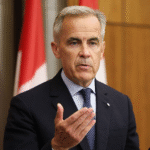

In a time when U.S. debt headlines dominate financial news and politicians sound alarm bells over trillion-dollar deficits, one of Wall Street’s most respected voices is urging calm. Steve Eisman—the legendary investor who predicted the 2008 housing crash and was famously portrayed in The Big Short—has weighed in on the national debt conversation. But unlike many, he’s not panicking. In fact, Eisman believes that the fear surrounding U.S. deficits is overblown and misdirected, especially in today’s economic climate. His message to investors? Focus less on doomsday debt theories and more on real market fundamentals.

Who Is Steve Eisman?

If you’ve seen The Big Short, you know Steve Eisman as the guy who called the 2008 housing collapse before anyone else. He’s not just a Wall Street legend—he’s a symbol of contrarian insight. So, when Eisman says not to panic about rising U.S. deficits, people listen.

The Deficit Panic—Is It Overblown?

U.S. national debt continues to rise past $34 trillion, and the federal deficit is a constant talking point in elections, financial news, and investor circles. Many fear inflation, higher interest rates, or an eventual market crash.

But Eisman says the panic is overhyped. His reasoning?

“The idea that the deficit is going to destroy the economy in the short term—I don’t buy it,” Eisman said during a Bloomberg interview in June 2025.

Eisman’s Core Argument

Eisman argues that government spending is only harmful when it causes runaway inflation. But current inflation trends are stabilizing, and the U.S. economy remains resilient. Key points from his analysis:

- The U.S. can handle more debt because its currency is the world’s reserve.

- Investors should focus on productivity, innovation, and earnings growth, not just debt numbers.

- Bond yields are normalizing, not spiking—showing that markets aren’t panicking.

What This Means for Traders & Investors

Eisman’s perspective can offer a confidence boost to investors worried about deficit-related headlines. For long-term investors:

- Don’t panic sell over budget news.

- Look for sectors where government spending boosts growth (tech, defense, infrastructure).

- Monitor inflation and Fed decisions, not just the debt clock.

Final Word

Deficits matter—but not in isolation. According to Steve Eisman, context, timing, and economic momentum are what really drive markets. And if one of the world’s most famous short-sellers isn’t shorting America’s future, maybe we shouldn’t either.